The Nucleate Artery: 3 exciting developments in SG biotech research, and what goes on in the heads of biotech investors

Get your news in fewer words: we reformat Digestibles

We are The Nucleate Artery, a monthly newsletter focused on the latest local biotech research and events.

Happy holidays! 🌲

We hope everyone has a nice holiday season! Rest, recharge and spend some time with your loved ones ❤️

🍽️ Digestibles

(Research that has been published within the past 2 months)

PRECISION ONCOLOGY: Personalised medicine holds potential for treating rare skin cancer with no effective systematic treatment

Metastatic porocarcinomas are highly aggressive skin tumours that have spread from the sweat glands. They have an incredibly high mortality rate of 60-70%, and patients who undergo chemotherapy and radiotherapy experience poor treatment outcomes. In this study by Chan et al., a personalised ex vivo drug screen predicted pazopanib efficacy for a lady in her 50s. A decrease in size and mass of her tumours was reported after two months of treatment, with no new lesions found on re-staging, and no drug-related side effects. This is the first proof-of-concept that demonstrates the effectiveness of personalised medicine for metastatic PC, paving the way for effective tailored treatments in other rare cancers.

Other developments in the Singapore precision oncology space:

A*STAR spin-off AVATAMED and IMCB set up a joint-service lab to offer patient-derived tumour samples drug screening services.

SG-based company Engine Biosciences that works on developing precision oncology medicines has recently secured a $27 M Series A extension.

BIOMATERIALS: Barnacle-inspired peptides demonstrate strong wet adhesivity

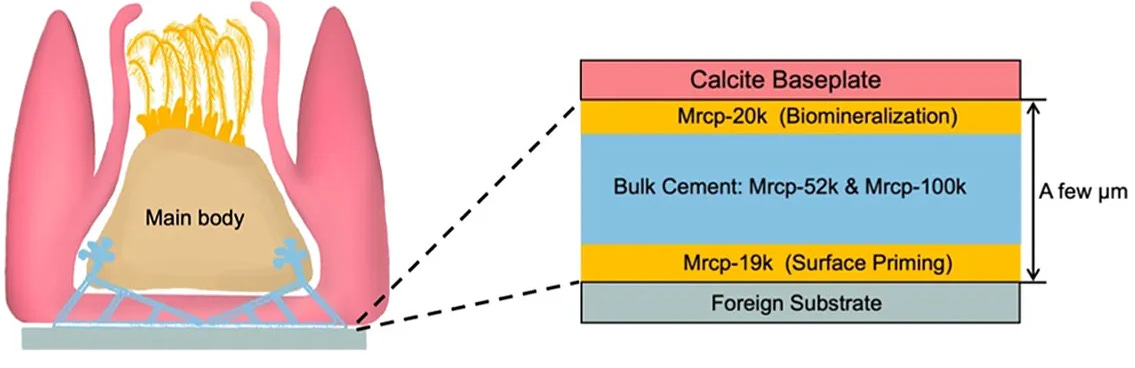

Ever had difficulty applying glue to a wet surface? Perhaps we can learn from the barnacle - the superglue producers of the ocean. In this study, co-first authors Mondarte and Wang delve into the realm of novel barnacle-inspired adhesives, to effectively build upon wet surfaces. In particular, a barnacle cement protein 19k (cp19k) has been speculated to be a key priming protein in the initial barnacle cement construction. Using sequence and structural analyses of cp19k as guiding principles, these designer peptides offer good flexibility and adhesion performance to both hydrophilic and hydrophilic surfaces. This opens the possibility of designing advanced wet adhesives with broad applicability to various surface types.

How some companies are doing this:

Mussel Polymers, Inc. introduced its proprietary Poly(Catechol-Styrene) molecule that induces the mineralization of dentin (a layer of tooth material), with potential applications in adhesives, functional coatings, medical and dental devices.

Illustration of Megabalanus rosa with highlighted distribution and function of different barnacle cement proteins. Reprinted with permission from Mondarte, E. A. Q., Wang, J., & Yu, J. (2023). Adaptive Adhesions of Barnacle-Inspired Adhesive Peptides. ACS Biomaterials Science & Engineering, 9(10), 5679-5686. Copyright 2023. American Chemical Society.

ENVIRONMENTAL SOLUTIONS: Enzyme engineered to degrade plastics two-fold faster

80% of global plastic usage is represented by polyethylene terephthalate (PET) [1], yet, only 9% of this widely used plastic material gets recycled, while the rest of the waste accumulates in landfills and the natural environment. Tiong et al. explored the Singapore-based Natural Organism Library (NOL) database for new PET-degrading enzymes among actinobacteria. One of the sequences shortlisted was optimised to give a 10-fold higher yield of enzymes during heterologous expression (~4 to 30-40 mg/L) and depolymerisation activity (2.5 times increase in activity compared to its original form). These superior yields, greater activity, and enhanced thermal stability against current standards, eases bottlenecks in further optimisation of PET degradation mechanisms - especially physical properties and processing conditions that in turn affects enzymatic degradability.

Have an idea for sustainability solutions?

[Open for applications] NEA Closing the Resource Loop (CTRL) Funding Initiative supports R&D on environmental solutions

NEA offers up to $1M via the 3R Fund to reduce waste disposed at incineration plants and disposal facilities

🥡 Event Takeaways

(Exclusive insights from biotech events in SG)

Venturing into Innovation: Insights from our venture capital workshops

Together with ClavystBio, Nucleate SG hosted a 3-session workshop series over Oct-Nov in hopes of demystifying the world of life science venture capital (VC), a world that remains an enigma for many. The workshops were expertly helmed by Dr Ho Wen Qi, Dr Alice Chen, and Dr Kim Png, seasoned investors, from whom we had the privilege of learning about the complexities and subtleties of life science investments. Here are some takeaways:

Venture building is key to nurture the young biotech ecosystem in Singapore

Venture capital is a form of private financing where investors provide capital to young companies. There are also venture builders, who invest capital AND provide operational support, infrastructure, and access to a vast network of connections [2]. Because the Singapore biotech ecosystem is a young and small one, the biotech startups are naturally more green than mature. As such, a more nurturing business model is adopted by many life sciences venture capital firms here, who are oftentimes also builders. This is a great resource to tap on for entrepreneurs new to this space, who feel like they want more support to develop their business, especially at the initial stage.

Fit is key: understand investor interests to determine the best VC to pitch to

Before the firm evaluates the company for investing, it first needs to determine if the technology aligns with the investment thesis of the company. This thesis is also called a fund strategy because it guides where the invested capital goes. It determines the:

Type of tech and company that gets funded: e.g., TechBio or Bio Platform (popular now), single- or multi- asset companies

Problem statements of interest: e.g., precision oncology, nutrition

Startup stage of interest: early stage, companies at the inflection point (point where a proof-of-concept gets taken to clinical trials), late stage

Have a fundable idea, but unsure who to approach for investment? Looking into the VC’s investment thesis could be a good starting point.

Life cycle of a venture fund affects investors’ risk appetite

VC funds have a 10-12 year long life cycle. In this time, VCs are expected to invest all the capital and return the profits to the investors. The year that the fund is formed is also known as its “vintage year”. It is at the beginning of a fund cycle that is correlated with an increase in risk appetite. This is also the best time for startups with more out-of-the-box – and hence, riskier – technologies to pitch to VCs. On the flip side, it is more likely for investors to invest more conservatively towards the end of a fund life cycle. Regardless of the kind of technology you are offering, strategising fundraising around a fund’s vintage year can help increase chances of making a deal.

High valuation may have significant downsides for startups

How a company is valued is known as the company valuation (read this great article on how startup ventures are valued). While it may feel more intuitive to want to get a higher valuation at initial rounds of fundraising, there are potential consequences to achieving high valuations. Firstly, because of the nature of fundraising, where valuation of a company is expected to increase at every funding round, it becomes difficult for investors to match or go higher than an already high valuation. This deters investors, who may think that the company is overvalued, which makes it hard to raise the next round of funds. Additionally, high valuations mean higher perceived value of a company, which translates to higher expected performance of the company. This puts a lot of pressure on the company to meet the expectations of the investors – not a comfortable position to be put in for a startup.

Venture is also a business about people

Building a biotech business is a long and challenging journey, the people who become part of this long-term endeavour become very important in determining the experience of building the company. All three speakers emphasised that good partnerships are built upon good relationships, and that stakeholders must like and believe in one another. In fact, as part of the homework that a VC does, team dynamics play a significant role in determining if a company is worth investing in. We encourage building these networks early in your careers; after all, old friends may be easier to not only approach, but also to understand.

Use our Singapore Life Science Slack Community to find a potential co-founder, an investor, or a collaborator.

We know networking can feel overwhelming. If this is uncharted territory for you, find out in our previous issue how we manage networking jitters.

A world made better via biotech

Biotech is a difficult business, whether you are an investor or founder. Unlike other sectors, building a biotech company is more expensive and takes much, much longer to bear fruit, if at all. Yet, when it does, it has an outsized impact on human health.

🎧 Nucleate Singapore Pulse

We interviewed Dr. Jonathan Ng, CEO and Founder of Iterative Health, a company that focuses on AI diagnostics for gastroenterology diseases.

View show notes and transcript

📆 Events happening this month

Discovery

5th Annual Vaccine World Asia Congress 2023: Singapore Company | IMAPAC

(30 Dec, 8:00 AM - 31 Dec, 6:00 PM, in person at Singapore 018956)

(10 Jan, 6:30 PM - 8:00 PM, in person at Singapore 059911)

(15 Jan - 16 Jan, virtual)